In India there is a wave of option traders. Every other person is trying his hands on the option trading in India. Considering that we have taken a stab at it. Below we will discuss how option trading in done in India, and then compare it with how to learn option trading in India.

Table of Contents

How to learn option trading in India?

Before we jump on some standard strategies that are very commonly executed by every new trader starting his trading journey. Let’s understand what are basic strategies to be taken into considerations:

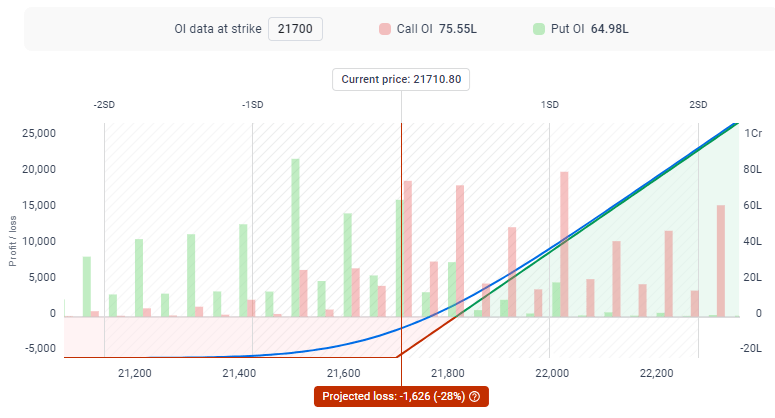

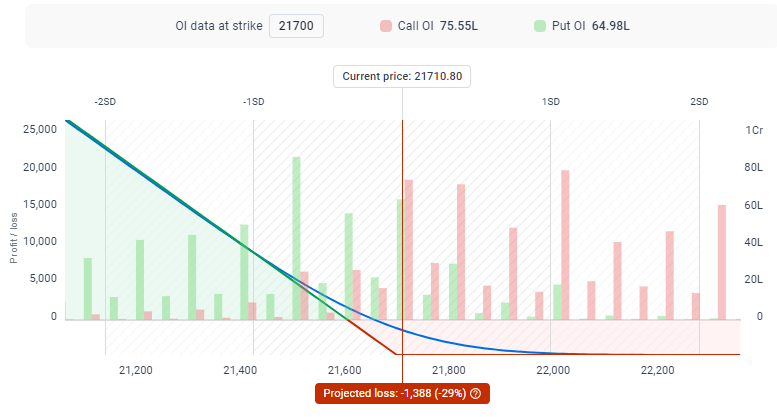

Long Call vs Long Puts

In this strategy a trader will buy a call or a put option. Why he/she will buy a call or a put option? Because he/she is taking the bet that market will go up hence buy call option and when he/she is taking the bet market is going to go down, then he is buying the put option. Most important question that floats there are plenty of strikes which one to be considered to buy? A decent answer would be ATM strikes!

Now let’s understand major disadvantage of this strategy. In options there is a component called Theta Decay. What exactly is this? With time premiums will melt away and become zero. So, if market doesn’t move in the desired direction before expiry then trader will loss entire premium that he has bought!

Covered Call & Protective Put

In this strategy a trader tries to hold his position in cash market, while he will sell call options and buy put as an insurance to his position. Good part of the strategy is if market goes up then you earn in cash market but make relatively less loss to no loss depending on which call strike has be sold. However if market choose to reverse and go down then you earn some income by call option decay and put option price increase.

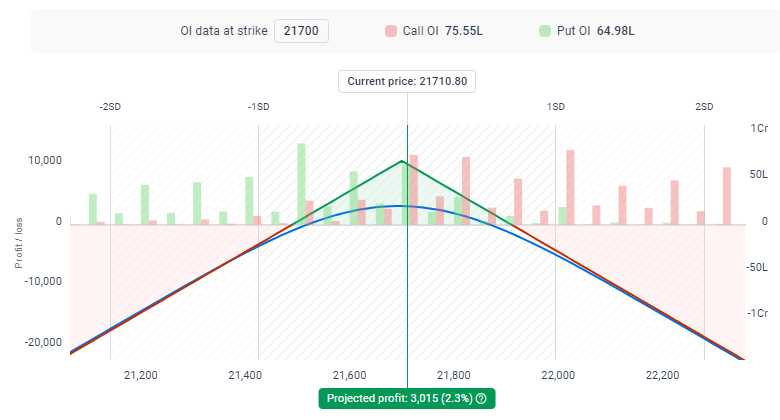

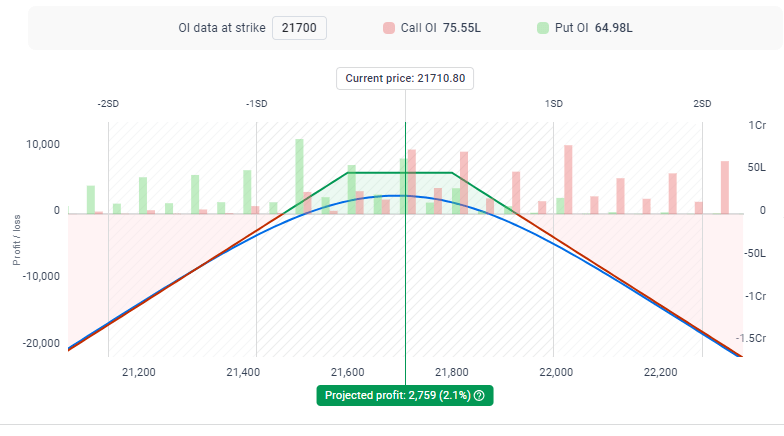

Straddle vs Strangle

This is the strategy majority of Indian traders love. In this strategy when call and put options are sold ATM strikes then it is a straddle strategy, which if strikes are sold at a distance from each other then it becomes strangle strategy. Majority of Indians execute this strategy. Good part of strategy is, all trader has to sit with his position, if it doesn’t move directionally then traders will earn however if market choose to move in either direction then trader will make losses. This is the ideal strategy for sideways market. Just a fun fact 60% of the times market tends to stay sideways.

But major disadvantage of this strategy is big move either direction. In this traders end up loosing by getting their stop loss hit most of time. Smart money loves to have retail traders hitting their stop loss. Now If you have a tool that is able to tell you don’t get worried by these big moves and market is still sideways, would that not give traders required edge? Perhaps our Greed and Fear Index – Sentiments Decoder can do that job for you, to make informed decisions.

These are just a few examples of option trading strategies, and there are many more variations and combinations available. Each strategy has its own risk profile, profit potential, and suitability for different market conditions. It’s important for traders to understand the characteristics of each strategy and select the one that aligns with their objectives and risk tolerance.