One of the most important aspect of learning intraday trading or swing trading, is to be able to do technical analysis of any instrument, that would include understanding candlestick patterns. Candlestick helps in understanding the market participant’s behavior. What is most fascinating, that how looking at candlestick patterns one can identify what sentiments are prevailing in the market. In our sentiment engine, this is what we have leveraged. As a part of sentiments decoder algorithms we detect these patterns algorithmically and then surface sentiments view based on chart patterns and technical analysis.

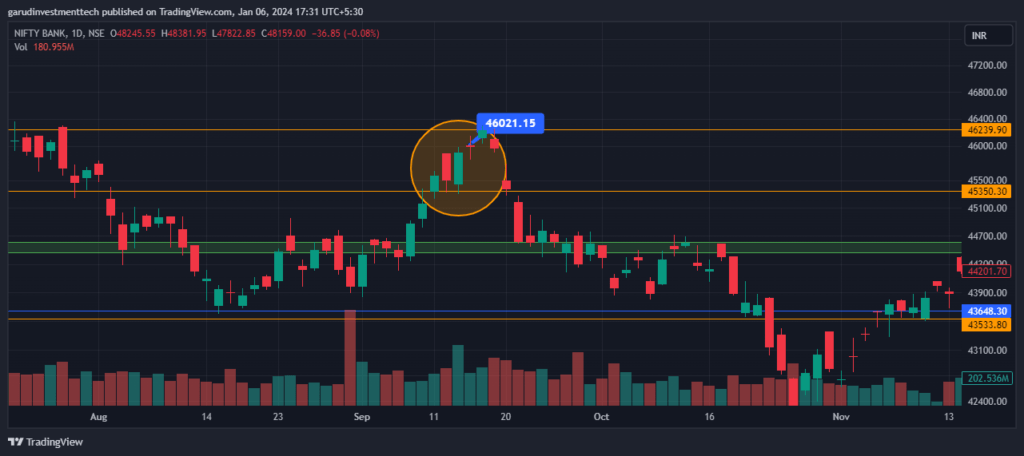

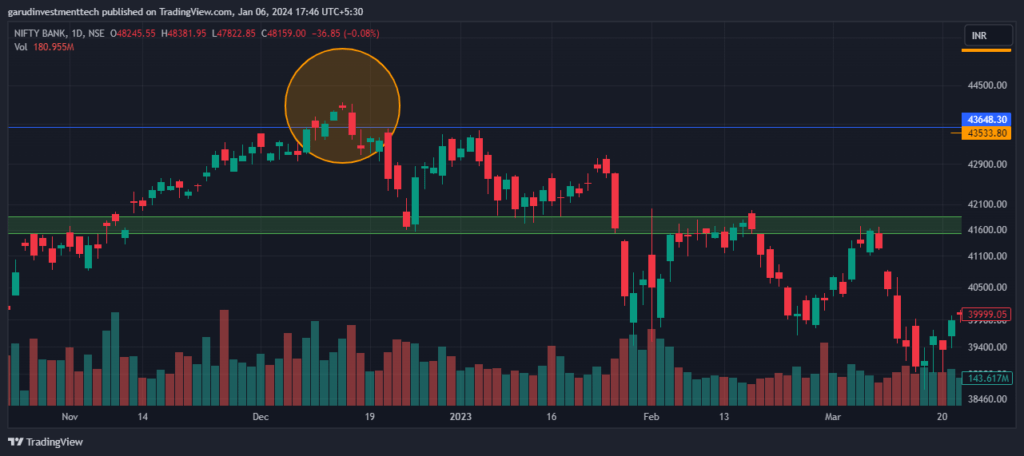

The most common patterns that we have decoded using our algorithms are mentioned below. Just to make this learning more practically let’s also take real case by doing Bank Nifty Analysis where we would try to read Bank Nifty Chart Patterns and understand them well. Below for explanation purpose we have concentrated on Bank Nifty only, however conceptually the technical analysis would stay same.

Table of Contents

Technical Analysis: Bank Nifty Chart Pattern

Doji Pattern

In a Doji pattern typically open is near to close and it has wicks on both side. Typically these wick could be of same or similar length. What it means market is indecisive. If it appears after a trend that means there is a good possibility of reversal or may continue the trend.

Engulfing

This pattern as name suggest is indicating bullishness or bearishness. Now, in this candlestick pattern a big candle body would engulf previous candle completely. If green candle engulfs previous red candle then Bullish move possibility, and if red candle engulfs previous green candle then Bearish move possibility.

Hammer & Shooting Star

In this pattern typically there is a small real body and long wick. If Hammer found after potential bullish pattern then possibility of reversal. Similarly if shooting star is found after falling market then possibility of bullish reversal.

Morning & Evening Star

This is a typical three candlesticks pattern that indicates bullish trend reversal. In a bullish reversal Its construction is of a long green candle, then an indecision Doji candle of any color and then big red candle. Reverse is true for Morning star having a big red candle in a falling trend, then a Doji and then Big green candle in reverse direction.

Frequently Asked Questions

How to read Bank Nifty Chart Patterns?

There is a very simple and easy way to read Bank Nifty chart patterns. Use Sentiments Decoder! Sign up and track what charts are communicating. Sentiments Decoder reduce entire market analysis into two words and one signal – Bullish, Bearish, Sideways to Bullish and Sideways to Bearish. Just sign up and start tracking bank nifty.

How do you find the trend of Bank Nifty?

There are two trends in the market – Bullish and Bearish trend. But these trends depends on the time frame in which you want to analyse. Sentiments Decoder identify these trends for four different timeframes – Intraday, Weekly, Multi-weeks and Multi-Months.

What is the bullish pattern in Bank Nifty?

When “Sentiments Decoder” is showing sentiments data above 0.5, then it is bullish pattern in Bank Nifty. Sentiments Decoder is AI driven algorithms that analyses these chart patterns and reduce it simple one of the market structure – bullish, bearish, sideways to bullish and sideways to bearish.