Effective risk management is crucial for any trading strategy, including a 1-minute scalping strategy. Here are some risk management practices to consider:

Table of Contents

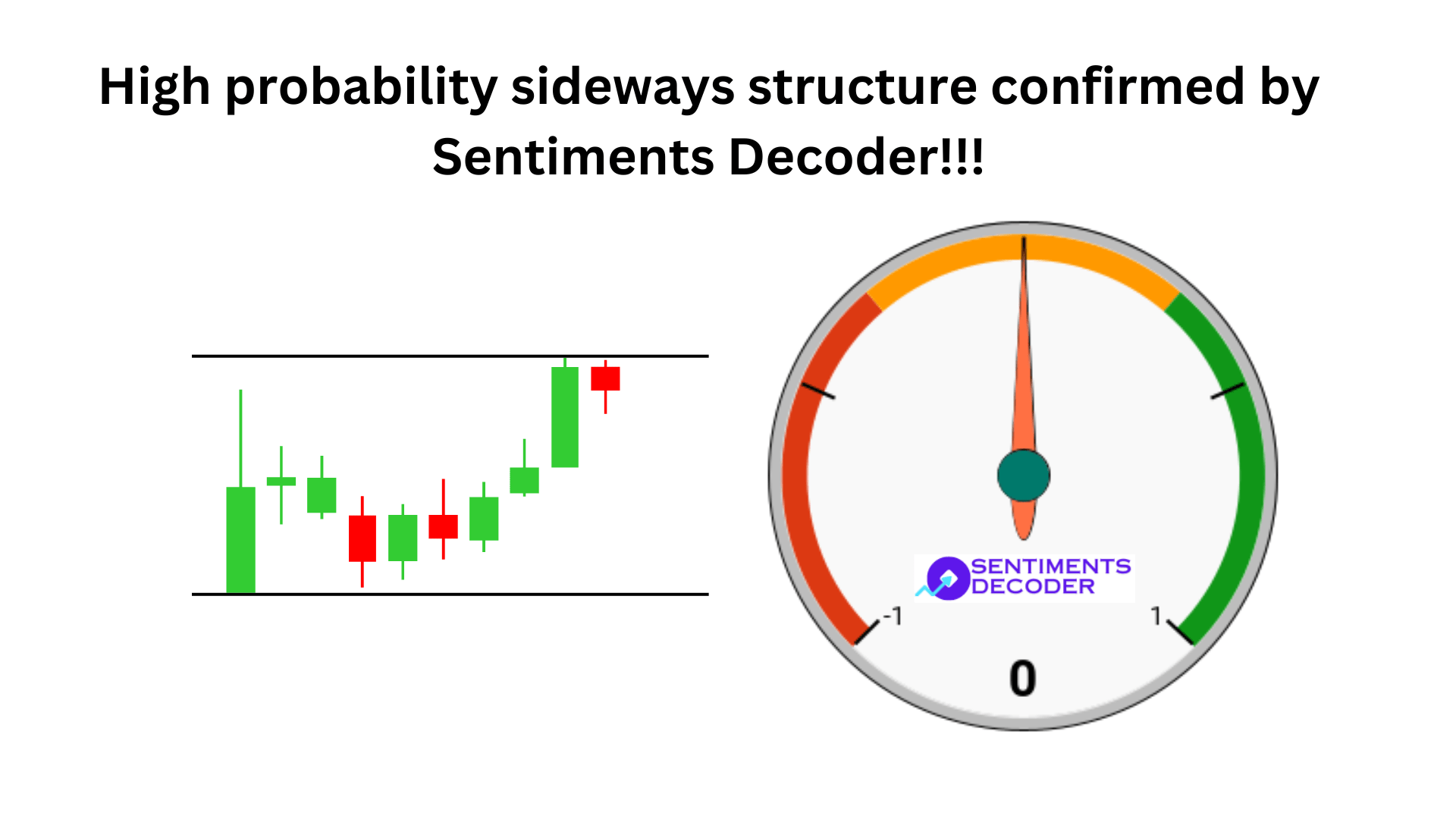

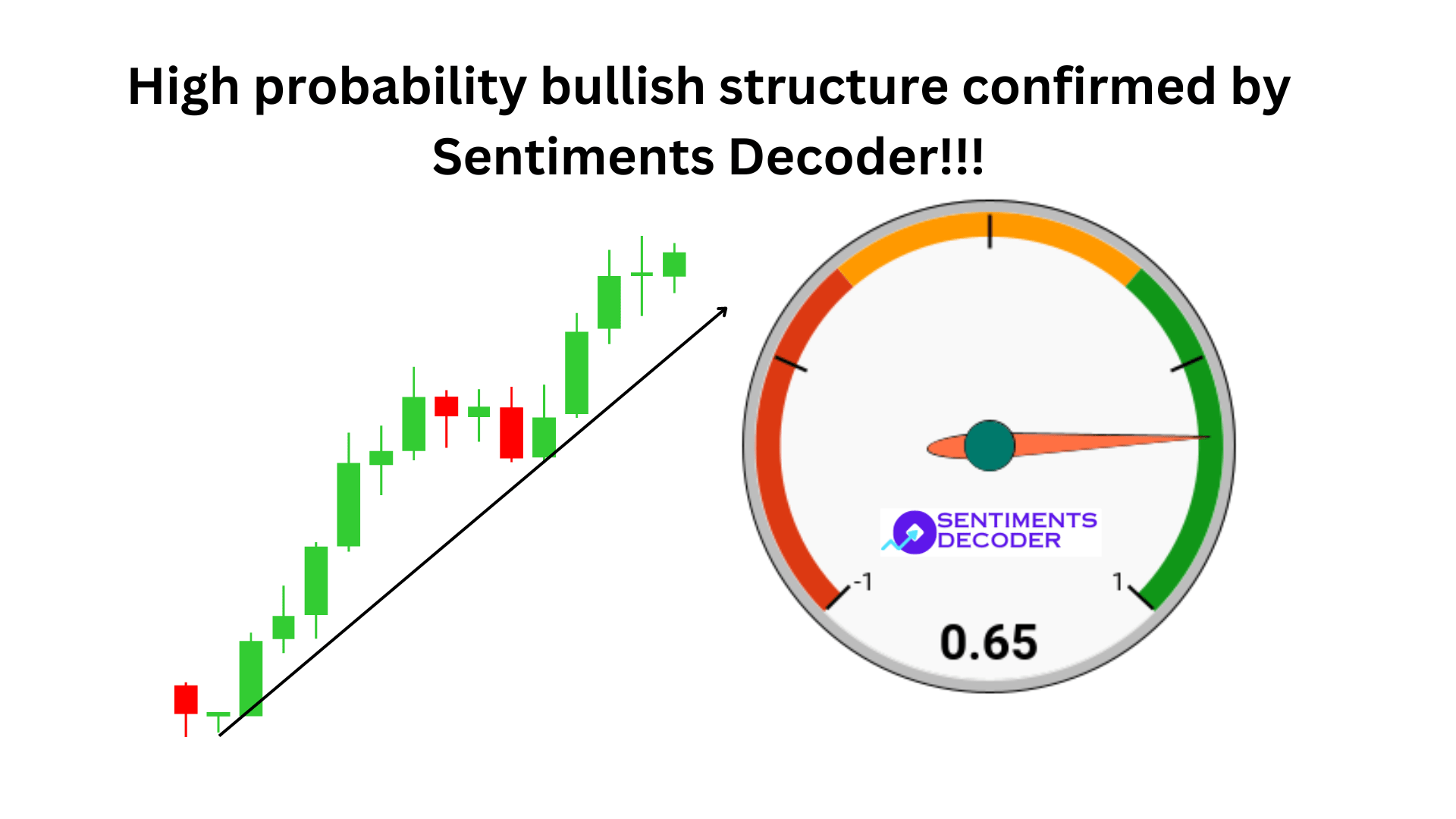

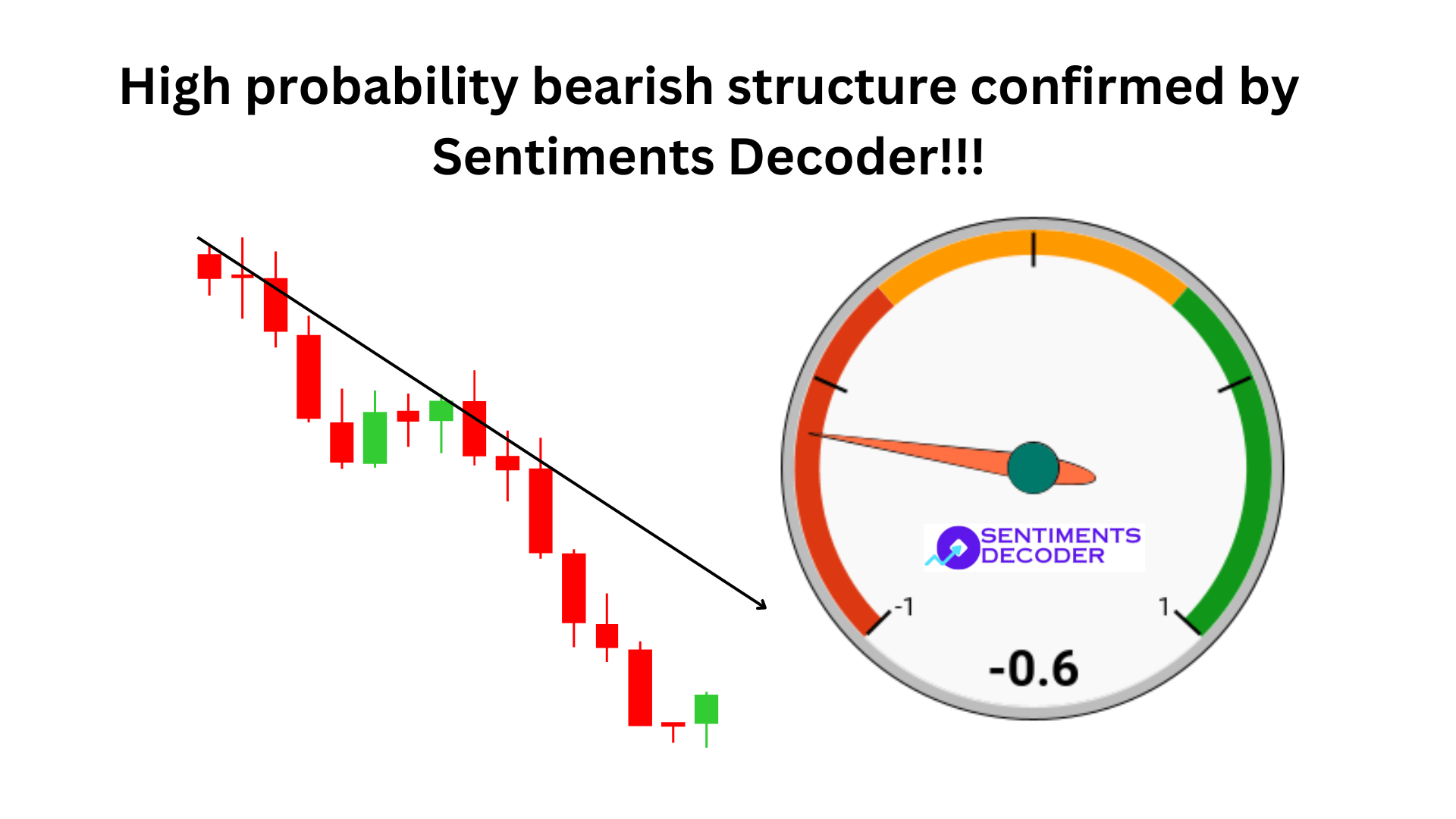

Confirm Intraday Sentiment

Before taking position in a stock or an index, trader must confirm what is the intraday sentiment using sentiments decoder. This will ensure, they are not taking position for 1 min scalping strategy against market sentiment at that moment. Check how sentiments decoder works!

Position sizing

Determine the appropriate position size for each trade based on your risk tolerance and account size. Avoid risking a significant portion of your trading capital on a single trade. Many traders recommend risking 1% or 2% of your capital per trade, but you can adjust this based on your risk appetite and strategy.

Stop loss orders

Always use stop loss orders to limit potential losses. Determine your stop loss level based on your analysis and risk management rules. Placing your stop loss beyond key support or resistance levels or based on technical indicators can help protect your trades from excessive losses.

Risk-reward ratio

Assess the risk-reward ratio for each trade. Aim for a favorable risk-reward ratio where the potential reward is greater than the risk taken. For example, targeting a 1:2 risk-reward ratio means you are willing to risk 1 unit to potentially gain 2 units. This helps ensure that your profitable trades outweigh the losing ones.

Trailing stops

Consider using trailing stops to protect your profits. Trailing stops allow you to adjust the stop loss level as the price moves in your favor, locking in profits and reducing the risk of giving back gains. This allows you to capture larger moves while protecting your capital.

Trade diversification

Avoid overexposing yourself to a single asset or market. Diversify your trades across different instruments or markets to spread your risk. This helps reduce the impact of potential losses on your overall trading account.

Risk assessment

Continuously assess the risk associated with each trade. Consider factors such as market volatility, upcoming economic events or news releases, and the potential impact they may have on your trades. Adjust your risk exposure accordingly to manage potential risks effectively.

Avoid revenge trading

Don’t let emotions drive your trading decisions. If you experience a series of losses, it’s essential to remain disciplined and avoid revenge trading by increasing your risk or deviating from your strategy. Stick to your risk management rules and maintain a level-headed approach.

Regular risk review

Periodically review your trading performance and risk management practices. Evaluate the effectiveness of your risk management techniques and make adjustments if needed. Learn from your past trades and identify any areas for improvement to enhance your risk management strategy.

Use demo accounts

Practice your scalping strategy on a demo account before trading with real money. This allows you to fine-tune your risk management techniques and gain confidence in your trading approach without risking actual capital.

Remember, risk management is an ongoing process that requires continuous monitoring and adjustment. By implementing these risk management practices, you can better protect your trading capital and increase the longevity of your 1-minute scalping strategy.